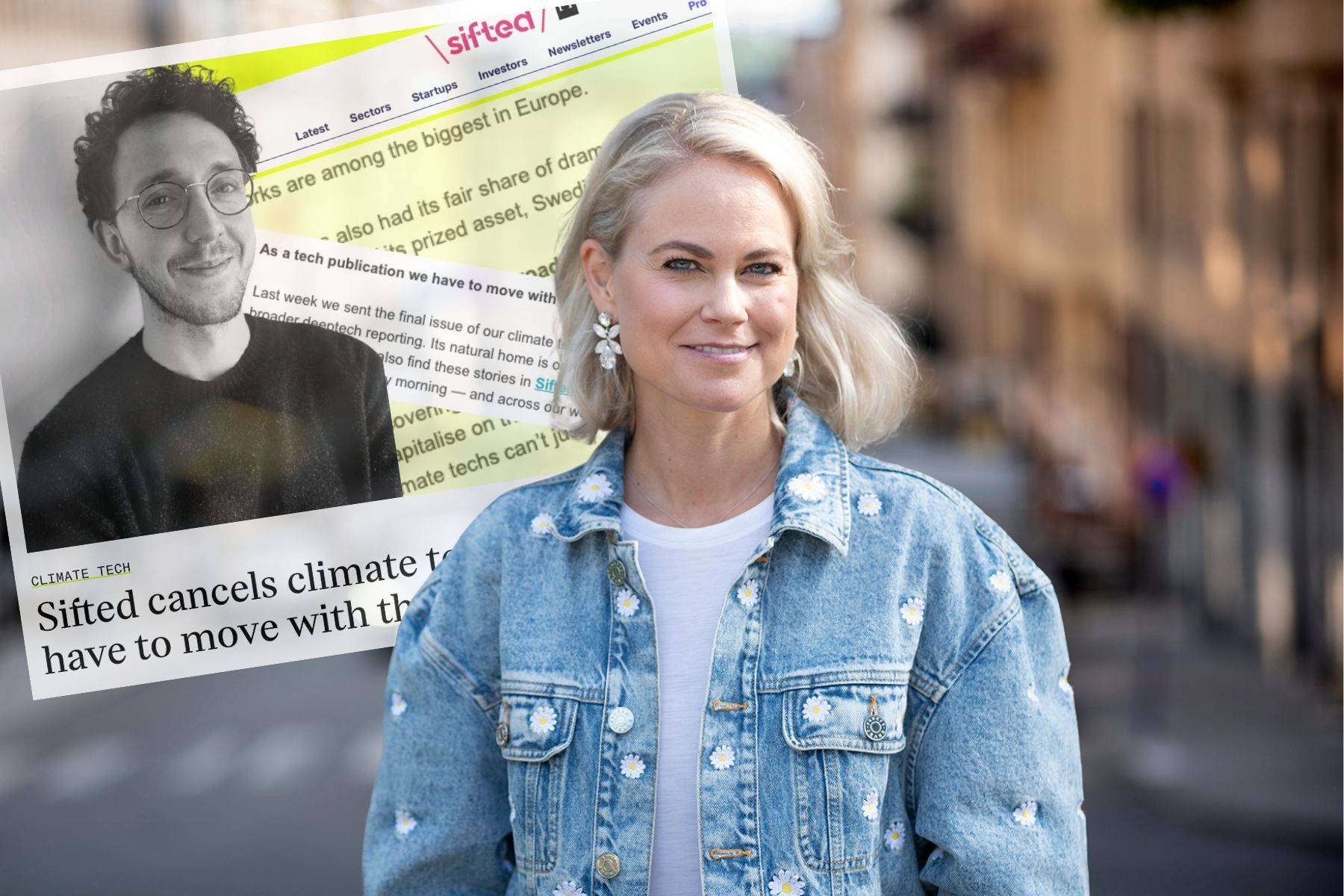

Future Energy Ventures confident about energy tech despite headwinds: ‘Everything we do is still valid’

After announcing the close of its €235 energy tech fund last week, Impact Loop caught up with partner and CFO Veronique Hördemann to discuss:<br><br>—> What kinds of startups they’re looking to invest in<br>—> How energy tech fits into resilience priorities <br>—> Recent political shifts in Germany against renewables<br><br>This is the first of our new article series ‘Behind the Fund’ which takes an inside look at impact-focused funds in Europe.<br>

.png)

Future Energy Ventures recently raised a new €235m Article 9 fund – and partner Veronique Hördemann says the thesis is almost unchanged from the firm’s first vehicle back in 2016. The focus remains software and asset-light tech to underpin Europe’s energy transition.

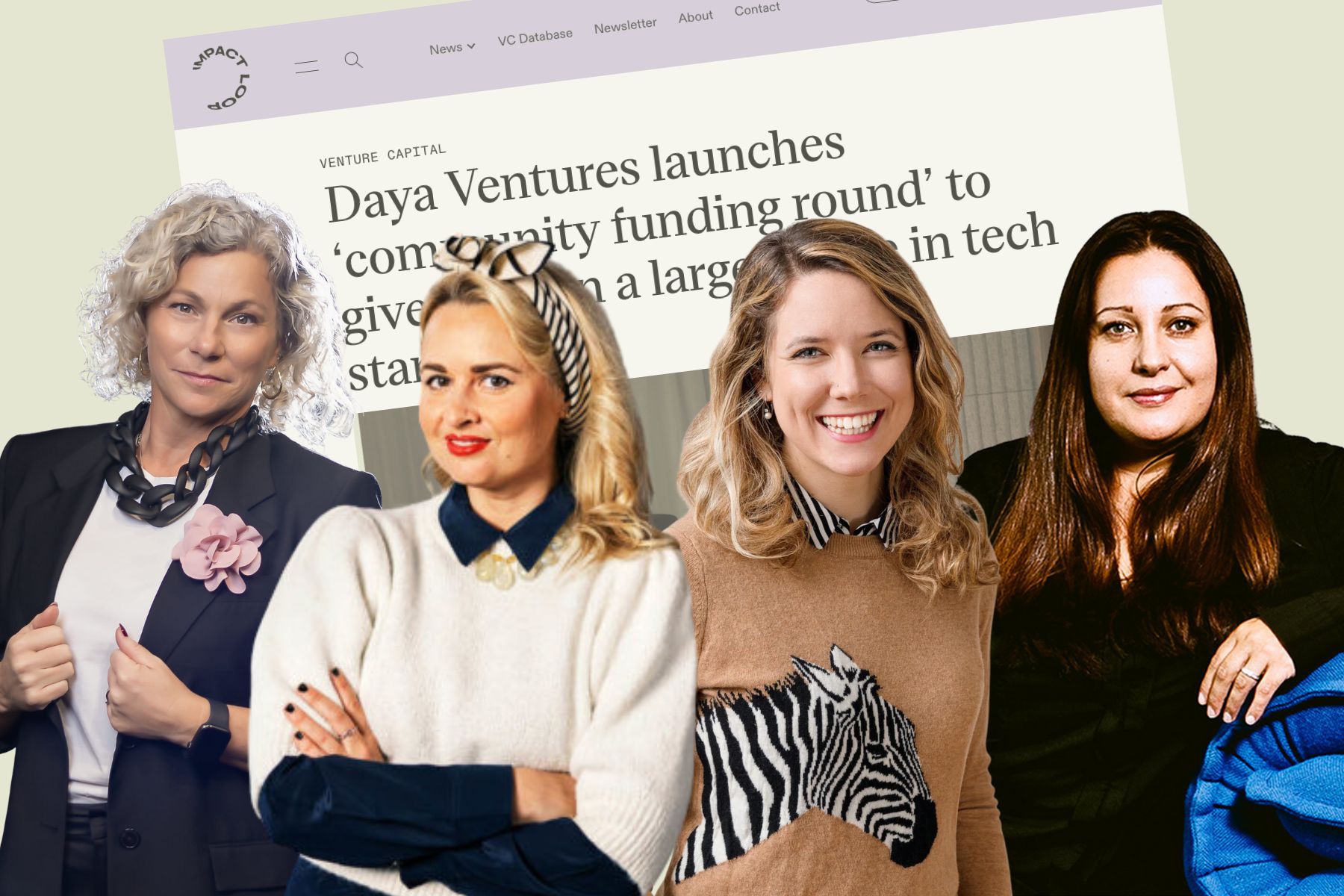

Fund I, backed solely by German energy utility E.ON, invested in more than 50 companies. Though E.ON remains an anchor, a broader mix of LPs has joined the second fund. They include the likes of KfW Capital, Telos Impact, and Sabanci Climate Ventures.

Hördemann admits fundraising took longer this time, with COVID, war in Europe, and the broader macroeconomic environment slowing commitments. Nevertheless she remains optimistic about the future of energy tech.

Resilience as the new framing

Hördemann says Europe’s burgeoning energy security narrative hasn’t forced a rewrite of the thesis. The same grid and orchestration tools they backed pre-Ukraine now look like resilience tech by default.

“Everything we do is still valid,” she said, pointing out that more efficient grids, smarter buildings, and reliable mobility systems all build resilience.

Political shifts in Germany

Hördemann says recent government changes have caused some uncertainty around subsidies, but they haven’t altered the underlying fact that renewables are still the cheapest source of energy.

“There was some turmoil or some changes in the political environment, but in the end, we still see the trend is there…from an economic point of view, there can't be a way around it,” she said.

Where they’re deploying now

New investments already include companies tackling grid optimisation, EV charging, building efficiency, predictive modelling, and early wildfire detection. The common thread is software that connects and protects fragmented energy assets.

“In order to make the energy transition work, we need the digital layer that connects everything,” Hördemann said.

Get full access to Europe's new platform for impact news

- Quality journalism, interviews, investor profiles and deep-dives

- Daily newsletter with top stories, latest funding rounds and roundup to keep you in the loop

Keep reading – get in the loop!

- Håll dig i loopen med vårt dagliga nyhetsbrev (gratis!)

- Full tillgång till daglig kvalitetsjournalistik med allt du behöver veta inom impact

- Affärsnätverk för entreprenörer och investerare med månatliga meetups

Fortsätt läsa – kom in i loopen!

- Håll dig i loopen med vårt dagliga nyhetsbrev (gratis)!

- Full tillgång till daglig kvalitetsjournalistik med allt du behöver veta inom impact

- Affärsnätverk för entreprenörer och investerare med månatliga meetups